Emergency Loans with No Credit Check

An emergency loan can come in handy if you need to cover the cost of a sudden expense. Traditional bank loans are typically only available to borrowers with excellent credit, so you might be wondering if it’s possible to get an emergency loan with no credit check.

Let’s dive deeper into how emergency loans work, whether you can get one with no credit check, and the types of emergency loans that may be available to you.

What is an emergency loan?

Emergency loans are meant to get you the money you need quickly. They’re mainly used for financial emergencies, such as an unexpected car repair. In many cases, the lender will distribute your funds the same day (or at least by the next business day) so you can take care of your expenses right away.

An emergency loan can be a great option if you don’t have the cash on hand to cover a leaky roof, flat tire, or other expense you never saw coming.

Where can I get an emergency loan?

Emergency loans are readily available from several different sources. If you have confidence in your credit history and want an emergency loan that requires a credit check, you can apply for a personal loan at your local bank or credit union.

However, if your credit history leaves much to be desired, you may be better off applying for an emergency loan with a direct lender.

Direct lenders like Advance America handle every aspect of your loan in-house, including the application, approval, funding, and repayment processes.

Because everything is handled in-house and direct lenders don’t work through a third party, the funding process is typically much faster.

Can I get an emergency loan with no credit check?

It can be difficult to find an emergency loan that doesn’t require a credit check. Fortunately, many direct lenders consider factors in addition to your credit score, such as your income and employment history. This means you may get approved for an emergency loan even if you have less-than-perfect credit.

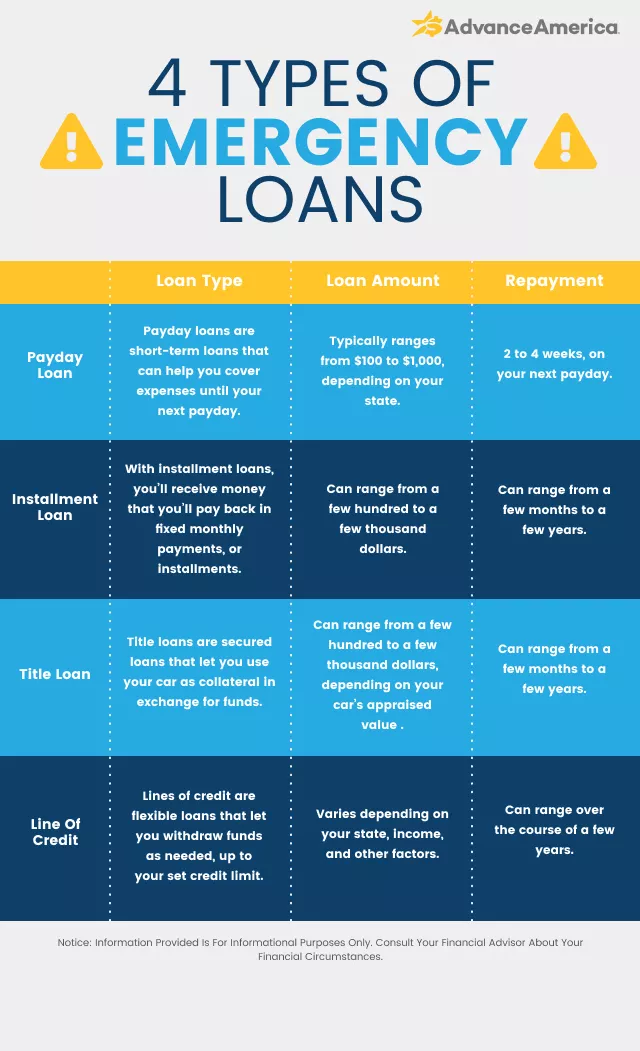

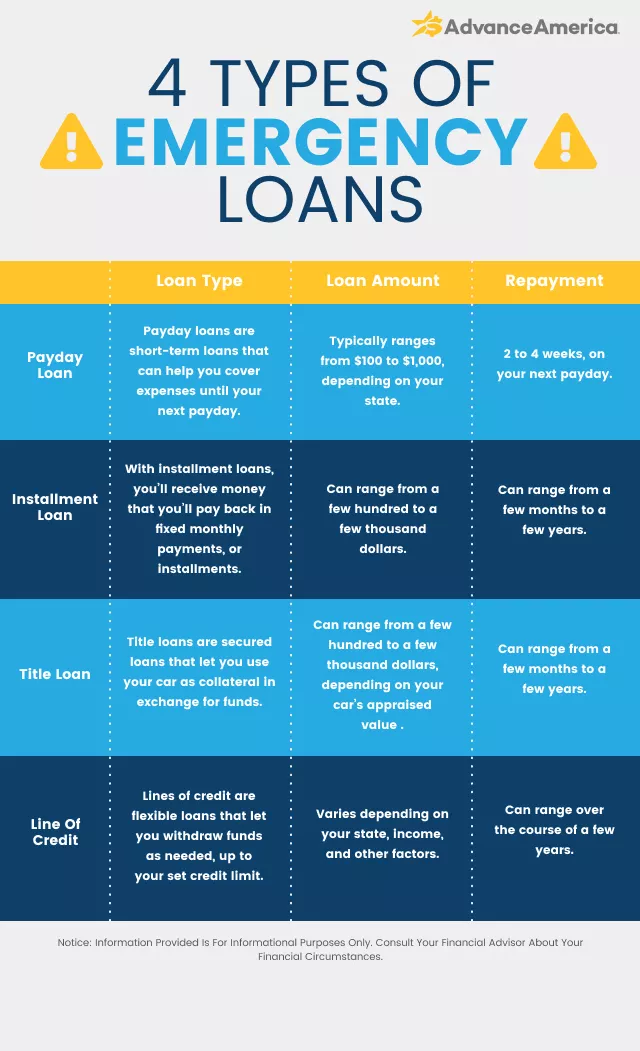

Common types

Payday Loans

Payday Loans are short-term, small dollar loans you repay on your next payday, which is usually within two to four weeks. They may make sense if you only need a few hundred dollars to hold you over until payday, but not if you need to borrow a larger lump sum or wouldn’t be able to afford the single repayment.

If you have poor or no credit, a Payday Loan could be your ideal type of emergency loan. That’s because most payday lenders will consider other factors beyond your credit score, such as your employment status and income.

Installment Loans

With an Installment Loan, you receive a lump sum of money upfront and pay it back over time in fixed payments (a.k.a. “installments”). If you need to borrow a large amount of money at once to cover an urgent expense, an Installment Loan may be a good option.

Title loans

Title loans are secured loans that use your car as collateral. The value of your vehicle will determine how much money you receive. Upon approval, the lender will give you a lump sum of cash in exchange for your vehicle title. You can keep driving your car as you repay the loan.

Advance America has partnered with LoanCenter to provide our customers with access to title loans.

Lines of Credit

A personal Line of Credit is similar to having a credit card. You’re approved for a set credit limit (or borrowing limit) and can withdraw as much or as little money as you’d like, as often as you’d like, up to your set credit limit. Plus, you’ll only pay interest on the amount you borrow – and your line stays open for future use even if you repay the balance.

Key benefits

Easy application process

Many direct lenders give you the option to apply for an emergency loan online from the comfort of home. These applications are typically easy to fill out and may only take you a few minutes to complete.

Receive funds quickly

You won’t have to wait long to receive the money from an emergency loan. Depending on the lender and the time of day you apply, you may even get the money in your bank account the same day. In other cases, you should receive the funds by the next business day.

Good credit is not needed

Depending on your lender, you may not need good credit to apply for an emergency loan. Many direct lenders specialize in no-credit-check options, so as long as you can prove you have a steady income and the ability to repay the loan on time, you may still be approved.

How to apply for an emergency loan with or without a credit check

Step 1: Compare lenders

Remember to do your research to figure out which lenders offer emergency no-credit-check loans. You’ll also want to read recent reviews on sites like Trustpilot to ensure you’re choosing a reputable lender with great customer service.

Step 2: Choose your loan

Look at factors like the loan amount, interest rate, repayment terms, and fees so you can select the right emergency loan for your situation.

Step 3: Gather your documents

Before you apply for an emergency loan, collect the documents you may need to complete your application, such as your driver’s license and pay stubs.

Step 4: Fill out and submit your application

Go to the lender’s website, fill out the application, and double-check the information you’ve entered before you hit submit, as any inaccurate or missing information could delay your approval decision.

Step 5: Receive your funds

If you’re approved, the lender may distribute your funds quickly, likely through direct deposit, a check, or a prepaid card.

How to choose the right loan for you

If you decide that an emergency loan is the best option for your financial situation, it’s important to choose the right one. Here how:

Compare interest rates

Understanding interest rates is important with any type of loan, but you may not think you can be picky because of the urgency involved with emergency loans. Still, it’s important to be mindful, as some lenders may try to take advantage of the fact that you need money fast.

When comparing interest rates, look for loans with transparent rates. At Advance America, you’ll always know the full cost of your loan before signing your loan agreement.

Decide on the right loan amount

It’s also essential to know how much money you need before applying for an emergency loan. Remember, certain types of emergency loans offer more funds than others. By knowing how much money you need, you can choose the right type of emergency loan for your needs.

Consider how quickly you need cash

While most no-credit-check emergency loans offer fast cash, certain types will get you your money faster than others. Payday Loans and Installment Loans, for instance, often have faster turnaround times than title loans and may be a better option when you need cash and can’t wait for an appraisal.

At Advance America, we offer same-day funding for online loans approved before 10:30 AM EST. If you miss the cutoff time, you’ll receive your funds on the next business day.

Check for any fees

In addition to interest rates, emergency loans can also have unwanted fees worked into the fine print. It’s important to check for these unwanted fees so you don’t end up overpaying for the loan and getting into an even worse financial situation.

Get an emergency loan from Advance America

Advance America offers no-credit-check emergency loans that can get you funds as soon as the same day you apply. Visit us in-store at a location near you or apply online now.